child tax credit portal says pending

I have already received my 2020 taxes months ago. If the Child Tax Credit Update Portal returns a pending eligibility status it means the IRS is still trying to determine whether you 1.

Why Is My Eligibility Pending For Child Tax Credit Payments

New Member July 11 2021 505 PM.

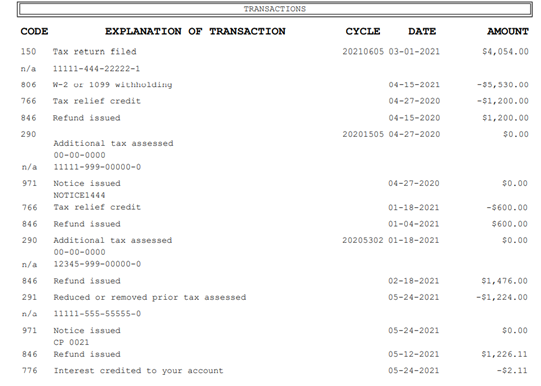

. To reconcile advance payments on your 2021 return. July 19 2021 923 AM. After talking to the IRS and finding out this was a glitch and happened to others.

Outdated IRS info can lead to missing or incorrect child tax credit payments. Youll need to print and mail the. Parents of children under age 6 would be eligible for an even larger 3600 total credit.

In the same boat. Does anyone elses child tax credit portal say pending eligibility. I have an amended return not sure if this is why.

If all else fails you can plan to claim the child tax credit when you file your 2021 taxes. The Child Tax Credit Update Portal is no longer available. Someone please explain to me why my ctc status still says pending eligibility you will not receive payments at this time.

One is 2 and the other is 9. Check the Child Tax Credit Update Portal Check the IRS Child Tax Credit Update Portal to find the status of your payments whether they are pending or processed. In a 35 trillion economic bill released on Sep.

I have received every stimulus check do NOT have an amended return and fit all eligibility requirements yet Im still pending eligibility. If the Child Tax Credit Update Portal returns a pending. Im going to scream.

Your eligibility is pending. In a 35 trillion economic bill released on Sep. Recipients can check the status of the monthly payment at the irs child tax credit update portal.

The tool also allows families to unenroll from the advance payments if they dont want to receive them. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. She used the Child Tax Credit Update Portal to double-check and got the message that nothing was pending.

Topic E if the IRS has not processed your 2020 tax return as of the payment determination date for a monthly advance Child Tax Credit payment we will determine the amount of that advance Child Tax Credit payment based on information shown on your. This is so frustrating. I STILL have not gotten a payment for September and it looks like my portal STILL says pending eligibility.

4 weeks since the payment was mailed by check to a standard address. 4 you still have a few weeks to do so. Remember the advance payments dont change the amount you get only when you get paid.

If the portal says a payment is pending it means the irs is still reviewing your account to. COVID Tax Tip 2021-101 July 14. Child tax credit portal says pending eligibility.

The IRS is hopelessly backlogged with 35 million unprocessed tax returns and 2 new laws to follow stimulus round 3 and the advance child tax credit payments. 10 House Democrats suggested extending the. My amended return was accepted but not processed and my CTC portal says pending will not receive advance payments.

As of October 16. My status on IRS portal says my CTC is pending. Many families agree as.

My 2020 return was processed but then went under review. Half will come as six monthly payments and half as a 2021 tax credit. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment.

If the Child Tax Credit Update Portal returns a pending eligibility status it means the IRS is still trying to determine whether you qualify. Currently the increased child tax credit payments are temporary lasting only for the 2021 tax year. Check mailed to a foreign address.

The IRS is providing eligible families with payments ranging from 250 to 300 per month. Monthly advance child tax credit payments have now ended in. I had to amend my return to get the 10200 unemployment tax.

The Advance Child Tax Credit Eligibility Assistant is the easiest way to check this. Key Democrats say they are pressing the IRS to overhaul the site to ensure its straightforward and easy for non-filers. Child Tax Credit 2021 This Irs Portal Is The Key To Opting Out And Updating Your Information Cnet.

28 2021 100 pm. Child tax credit portal says pending eligibility. Why does my child tax credit say pending opt out of child tax creditWatch Our Other VideosIRS unemployment tax refund.

Its a miracle that even some people have been paid. At first glance the steps to request a payment trace can look daunting. Your eligibility is pending.

COVID Tax Tip 2021-101 July 14 2021. She used the Child Tax Credit Update Portal to double-check. 5 days since the deposit date and the bank says it hasnt received the payment.

The IRS wont send you any monthly payments until it can confirm your status. The IRS will pay 3600 per child to parents of children up to age five. Child tax credit portal says pending eligibility.

If the Child Tax Credit Update Portal returns a pending eligibility status it means the IRS is still trying to determine whether you qualify. I am qualified and received the first letter. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you.

Parents Take To Twitter Again About Shortages In October S Child Tax Credit Payment

Child Tax Credit Will There Be Another Check In April 2022 Marca

H R Block A Portion Of Your Child Tax Credit Payments Ctc Will Now Be Distributed Through Advance Payments That Means If You Want To Opt Out Of These You Ll Need To

What To Do If You Still Haven T Received Your Child Tax Credit Payment Forbes Advisor

Where S My Child Tax Credit Payment A Guide For Frustrated Parents The Washington Post

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Child Tax Credits September Payments Go Out Soon What To Do If You Don T Get One

9 Reasons You Didn T Receive The Child Tax Credit Payment Money

Need All India Itr Everify Itr V Online Income Tax Return Income Tax Tax Deducted At Source

How Does Child Tax Credit Work For Divorced Parents And Other Non Traditional Families The Washington Post

Irsnews On Twitter There Have Been Changes To The Child Tax Credit For 2021 And The Credit Amounts Will Increase For Many Taxpayers Learn More From Irs At Https T Co 535gr8fjvp Https T Co Bgyzn36d4v Twitter

Why Is My Eligibility Pending For Child Tax Credit Payments

Child Tax Credit August Update How To Track It Online Marca

What To Know If You Didn T Get The First Child Tax Credit Payment

Parents Cheer The First Of Six Advance Child Tax Credit Payments

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc11 Raleigh Durham

New Child Tax Credit Payouts Released Soon Try This If Yours Is Late Or Wrong

Missing A Child Tax Credit Payment Here S How To Track It Cnet